Alternatives to Stocks: A Comprehensive Guide

Introduction

In the world of investments, stocks have long been the cornerstone of many portfolios. They represent ownership in a company and constitute a claim on part of the company’s assets and earnings. However, as with all investments, stocks come with their own set of risks and rewards. This section delves deep into traditional stock investments, their advantages, and the inherent need for diversification.

What Are Stocks?

Stocks, often referred to as shares or equities, are financial instruments that represent ownership in a company. When you buy a stock, you’re purchasing a piece of that company, making you a shareholder. Companies issue stocks to raise capital, either to fund new projects or to grow their operations.

| Type | Description |

|---|---|

| Common Stocks | These are the most common type of stocks that investors buy. Shareholders have voting rights but also bear the most risk. |

| Preferred Stocks | Preferred stockholders have a higher claim on dividends and assets but usually don’t have voting rights. |

Advantages of Investing in Stocks

- Potential for High Returns: Historically, stocks have provided a higher average return compared to other investments.

- Liquidity: Stocks are easily tradable on stock exchanges, making them highly liquid assets.

- Dividend Income: Some stocks provide regular income in the form of dividends.

- Ownership: Holding stocks means having a stake in the company, which can come with voting rights.

Risks Associated with Stock Investments

However, the allure of high returns comes with its set of risks:

- Market Risk: Stock prices can be volatile and can decrease in value rapidly.

- Liquidity Risk: While stocks are generally liquid, there’s no guarantee you’ll be able to sell your stocks at your preferred price.

- Interest Rate Risk: Rising interest rates can lead to falling stock prices.

- Country and Currency Risk: Stocks can be affected by political events or fluctuations in currency values.

The Imperative of Diversification

Diversification is the practice of spreading investments across various assets to reduce risk. The idea is that different assets will respond differently to the same economic event. So, while some assets might suffer, others might gain, balancing the portfolio.

| Criteria | Stocks | Real Estate | Gold | Bonds |

|---|---|---|---|---|

| Potential Return | High | Medium | Low to Medium | Low |

| Liquidity | High | Low | Medium | High |

| Risk | High | Medium | Medium | Low |

| Income Generation | Dividends | Rental Income | None | Interest |

While stocks have been a favored choice for many investors, the dynamic nature of the global economy and the associated risks emphasize the importance of diversification. Exploring alternatives to stocks can not only hedge against potential market downturns but also open avenues for new investment opportunities.

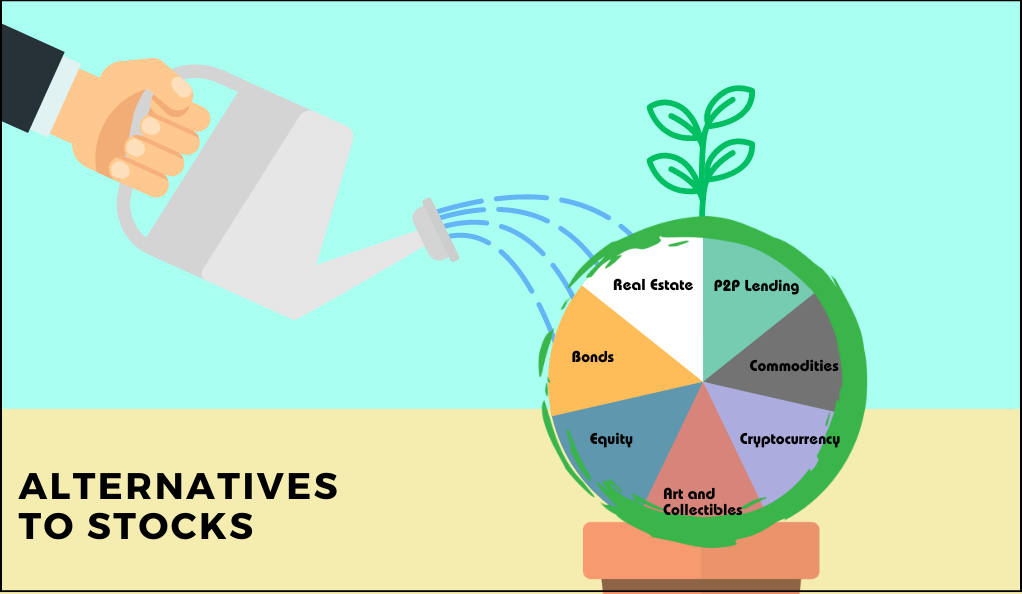

Alternative stocks

Within the vast realm of investment opportunities, while traditional stock investments have historically dominated the scene, they aren’t the sole contenders. There exists a rich tapestry of alternatives to stocks that savvy investors can explore.

Real Estate Investments: A Tangible Path to Wealth Creation

Real estate, often termed as ‘brick and mortar’, stands as one of the oldest and most trusted forms of investment. Unlike stocks or bonds, real estate is tangible, meaning you can touch, see, and utilize it. This section delves deep into the world of real estate investments, exploring its various facets, benefits, and challenges.

Understanding Real Estate as an Investment

Real estate investment involves purchasing property to generate a return on investment (ROI). This return can come in the form of rental income, property appreciation, or both. The property can range from residential homes to commercial spaces and even vacant land.

Types of Real Estate Investments

| Type | Description |

|---|---|

| Residential | Properties like houses, apartments, townhouses where people live. |

| Commercial | Office buildings, retail spaces, and warehouses. |

| Industrial | Factories, mines, and large-scale production houses. |

| Retail | Shopping malls, storefronts, and other retail establishments. |

| Mixed-Use | Properties that combine any of the above, e.g., a building with retail on the ground floor and apartments above. |

Benefits of Investing in Real Estate

- Steady Income Stream: Rental properties can provide a consistent income stream, often higher than dividend yields from stocks.

- Appreciation Potential: Over time, properties generally appreciate in value, leading to increased net worth.

- Tax Benefits: Real estate investors can avail of various tax deductions, including depreciation and mortgage interest.

- Diversification: Real estate can act as a hedge against the stock market, adding diversification to an investment portfolio.

Challenges in Real Estate Investment

- High Entry Costs: Purchasing property often requires significant capital, making it a high entry barrier for many.

- Liquidity Issues: Unlike stocks, selling property can be time-consuming and challenging, especially in a slow market.

- Maintenance Costs: Properties require regular maintenance, which can eat into the ROI.

- Market Volatility: Just like any investment, real estate markets can be unpredictable, influenced by economic factors and interest rates.

Real Estate Investment Trusts (REITs)

For those who want to invest in real estate without purchasing property, REITs offer an alternative. REITs are companies that own, operate, or finance income-producing real estate across various sectors. They offer a way to invest in real estate through the stock market.

Comparison Table: Direct Property Investment vs. REITs

| Criteria | Direct Property Investment | REITs |

|---|---|---|

| Liquidity | Low | High |

| Entry Cost | High | Low (Price of a share) |

| Maintenance | Investor’s Responsibility | Managed by REIT |

| Diversification | Limited to owned properties | Diverse portfolio of properties |

| Dividend Income | Rental Income | Regular Dividends from REIT |

Emerging Trends: Real Estate Crowdfunding

With the rise of digital platforms, real estate crowdfunding has emerged as a popular way to invest in property. Investors can pool their money to fund real estate projects, earning returns once the project is completed or starts generating income.

Real estate stands as a testament to the age-old adage, “They’re not making any more land.” Its tangible nature, coupled with the potential for steady income and appreciation, makes it a favored choice for many investors. Whether you’re directly buying property, investing in REITs, or exploring crowdfunding, real estate offers diverse avenues to grow wealth.

Peer-to-Peer Lending: Democratizing the World of Finance

In the age of digital transformation, the financial landscape has seen a shift from traditional banking systems to more decentralized and accessible platforms. One such innovation is Peer-to-Peer (P2P) lending, which connects individual borrowers with individual lenders, bypassing the need for traditional financial institutions. This section delves into the intricacies of P2P lending, its benefits, challenges, and its growing significance in the investment world.

What is Peer-to-Peer Lending?

P2P lending, often simply termed as “crowdlending”, is a method where individuals can directly lend to borrowers, be it individuals or small businesses, through online platforms. These platforms act as intermediaries, vetting both lenders and borrowers, setting interest rates, and facilitating the loan process.

Advantages of P2P Lending

- Higher Returns: Typically, P2P lending can offer higher returns compared to traditional savings or fixed deposit accounts.

- Diversification: Investors can spread their funds across multiple loans, reducing the risk associated with any single borrower defaulting.

- Flexibility: With varying loan durations and amounts, investors can choose lending opportunities that align with their financial goals.

- Direct Impact: Lenders can directly support individuals or small businesses, fostering a sense of community and personal impact.

Challenges and Risks

- Credit Risk: Unlike bank deposits, P2P loans aren’t insured. If a borrower defaults, the lender might lose their principal amount.

- Platform Risk: The stability and security of the P2P platform are crucial. If a platform goes bankrupt or faces regulatory issues, it can impact both lenders and borrowers.

- Liquidity Concerns: While some platforms offer secondary markets to sell loans, P2P investments are generally less liquid than stocks or bonds.

- Regulatory Landscape: The P2P lending industry is still evolving, and regulatory changes can influence the platform’s operations and investor returns.

P2P Lending Platforms: A Closer Look

Several platforms have risen to prominence in the P2P lending space, each with its unique features and focus:

- LendingClub: One of the pioneers in the industry, LendingClub offers personal loans, auto refinancing, and business loans.

- Prosper: Known for its personal loan offerings, Prosper allows investors to choose loans based on credit scores, ratings, and histories.

- Funding Circle: Focusing on small business loans, Funding Circle connects businesses with investors willing to fund their growth.

The Future of P2P Lending

With advancements in technology, especially AI and machine learning, P2P platforms are becoming more sophisticated in assessing credit risks. Additionally, as more investors seek alternative investment avenues and borrowers look for hassle-free loan processes, the P2P industry is poised for significant growth.

P2P lending stands as a testament to the power of community-driven finance. While it comes with its set of challenges, its potential for high returns and direct impact makes it an enticing alternative to traditional stock investments.

Commodities: Gold and Silver – The Timeless Storehouses of Value

Venturing beyond the digital and tangible realms of P2P lending and real estate, we find ourselves in the age-old domain of commodities. Gold and silver, in particular, have been revered since ancient times, not just for their beauty and use in jewelry but also for their intrinsic value as forms of currency and investment. This section delves deep into the world of these precious metals, shedding light on their significance in the modern investment landscape.

Historical Significance of Gold and Silver

Gold and silver have been symbols of wealth and power for millennia. Ancient civilizations, from the Egyptians to the Romans, have used these metals as currency, in rituals, and as symbols of divine favor.

Why Invest in Gold and Silver?

- Hedge Against Inflation: As fiat currencies can be subject to inflation, gold and silver often retain their value over time, making them a popular hedge.

- Safe Haven: In times of economic uncertainty or geopolitical tensions, investors often flock to gold and silver as “safe-haven” assets.

- Diversification: Adding precious metals to a portfolio can provide diversification, potentially reducing overall risk.

Physical vs. Paper Investments

While many investors prefer holding physical gold and silver in the form of coins, bars, or jewelry, others opt for paper investments like:

- Exchange-Traded Funds (ETFs): These track the price of gold or silver and can be traded like stocks.

- Futures Contracts: Agreements to buy or sell a specific amount of gold or silver at a predetermined price on a set future date.

Factors Influencing Gold and Silver Prices

- Supply and Demand: Like any commodity, the balance of supply and demand can influence prices.

- Central Bank Activities: Purchases or sales of gold by central banks can impact its price.

- Interest Rates: Generally, when interest rates rise, gold prices might decline as other assets yielding a return become more attractive.

- Geopolitical Events: Wars, political unrest, and economic crises can drive investors to gold and silver, increasing demand and potentially raising prices.

Challenges in Investing in Precious Metals

- No Passive Income: Unlike stocks or real estate, gold and silver don’t generate dividends or rental income.

- Storage Costs: Physical gold and silver need secure storage, which can come with costs.

- Price Volatility: While generally stable, gold and silver prices can be influenced by various global factors, leading to short-term volatility.

Equity Crowdfunding: Empowering the Crowd in the Investment Arena

In the age of the internet and democratized access to financial opportunities, equity crowdfunding has emerged as a powerful tool that bridges the gap between startups seeking capital and individual investors looking for innovative ventures to back. This section delves into the nuances of equity crowdfunding, exploring its mechanics, benefits, challenges, and its transformative impact on the investment ecosystem.

What is Equity Crowdfunding?

Equity crowdfunding is a method where individuals invest in early-stage companies in exchange for equity or shares in that company. Unlike traditional crowdfunding, where backers might receive a product or service in return for their support, equity crowdfunding offers a stake in the company itself.

The Rise of Equity Crowdfunding Platforms

Several platforms have emerged, democratizing the investment process and offering a curated selection of startups for potential investors:

- AngelList: A platform that connects startups with angel investors, offering curated investment opportunities.

- SeedInvest: Focusing on highly vetted startups, SeedInvest provides a platform for both investors and companies seeking capital.

- CircleUp: With a focus on consumer brands, CircleUp offers both equity crowdfunding and a secondary market for trading shares.

Benefits of Equity Crowdfunding

- Access to Innovative Startups: Investors get a chance to back promising startups at an early stage, potentially reaping significant rewards if the company succeeds.

- Diversification: By investing small amounts in multiple startups, investors can diversify their portfolios beyond traditional assets.

- Empowerment: Startups that might not have access to traditional financing can tap into a community of supporters and investors.

Challenges and Risks

- High Risk: Startups, by nature, are risky ventures. Many fail within the first few years, which could lead to a loss of investment.

- Liquidity Concerns: Shares acquired through equity crowdfunding may not be easily tradable, leading to potential liquidity issues for investors.

- Due Diligence: While platforms vet startups, the onus is still on the investor to conduct thorough research and understand the risks.

Regulatory Landscape

Given its relatively recent emergence, the regulatory framework for equity crowdfunding is still evolving:

- In the U.S., the SEC’s Regulation Crowdfunding (Reg CF) governs equity crowdfunding, setting limits on how much companies can raise and how much individuals can invest.

- In the U.K., the Financial Conduct Authority (FCA) oversees equity crowdfunding, ensuring platforms operate transparently and in the best interests of investors.

The Future of Equity Crowdfunding

With advancements in technology and a growing emphasis on community-driven finance, equity crowdfunding is poised for significant growth. As more startups seek alternative funding routes and investors look for unique opportunities, this method of investment will likely play an increasingly prominent role in the financial landscape.

Equity crowdfunding stands as a testament to the power of community and technology combined. By breaking down traditional barriers to investment and empowering both startups and individual investors, it’s reshaping the way we think about equity, ownership, and financial collaboration.

Cryptocurrency: The Digital Gold of the 21st Century

As we transition into an era defined by digital innovation, cryptocurrency has emerged as a revolutionary form of decentralized finance, challenging traditional financial systems and reshaping the way we think about money.

Cryptocurrency, often simply termed as ‘crypto’, is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies issued by governments and central banks, cryptocurrencies operate on technology called blockchain, a decentralized technology spread across many computers that manage and record transactions.

The Pioneer: Bitcoin

Introduced in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin was the first cryptocurrency and remains the most well-known and valuable. It introduced the concept of the blockchain and set the stage for thousands of subsequent digital currencies.

Benefits of Investing in Cryptocurrency

- Potential for High Returns: Cryptocurrencies have shown the potential for dramatic price increases over short periods.

- Liquidity: With 24/7 trading and numerous exchanges, cryptocurrencies offer high liquidity.

- Decentralization: Cryptos operate independently of central banks, offering a form of ‘financial freedom’.

- Diversification: Cryptocurrencies can add diversification to traditional investment portfolios.

Risks and Challenges

- Price Volatility: Cryptocurrencies are known for their price volatility, with values that can swing dramatically in short periods.

- Regulatory Concerns: The regulatory environment for cryptocurrencies is still evolving and can vary by jurisdiction.

- Security Issues: While cryptos are secure, exchanges and wallets can be vulnerable to hacks.

- Adoption Uncertainty: The future adoption and acceptance of cryptocurrencies as a mainstream form of payment remain uncertain.

Altcoins: Beyond Bitcoin

While Bitcoin is the most recognized cryptocurrency, there are thousands of alternative coins, or ‘altcoins’, each with its unique functionalities. Some notable ones include:

- Ethereum: Known for its smart contract functionality.

- Ripple (XRP): Focused on facilitating real-time global payments for banks.

- Litecoin: Created as the “silver” to Bitcoin’s gold.

The Role of Cryptocurrency Exchanges

Platforms like Coinbase, Binance, and Kraken allow users to buy, sell, and trade various cryptocurrencies. These exchanges play a pivotal role in determining the price and liquidity of cryptos.

The Future of Cryptocurrencies

With advancements like the introduction of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs), the crypto space is rapidly evolving. As more institutions begin to adopt and invest in cryptocurrencies, and as technological innovations continue to drive the sector forward, the future of digital currencies looks promising.

Cryptocurrencies represent a frontier in the financial world, offering both unprecedented opportunities and challenges. As with any investment, understanding the landscape, conducting thorough research, and approaching with caution are crucial. In the ever-evolving world of digital finance, staying informed is the key to success.

Art and Collectibles: Investing Beyond the Tangible

In the diverse spectrum of investments, art and collectibles occupy a unique space, blending financial aspirations with personal passions. From timeless masterpieces to rare stamps, coins, and vintage cars, this realm offers both aesthetic pleasure and potential financial returns. This section delves into the intricate world of art and collectibles, exploring their value as alternative investments and the nuances that define their market dynamics.

The Allure of Art as an Investment

Art, beyond its aesthetic and cultural significance, has long been recognized as a store of value. Collectors and investors alike have turned to art, not just for the love of it but also for its potential to appreciate over time.

Types of Collectible Investments

- Fine Art: Includes paintings, sculptures, and installations from various art movements and periods.

- Vintage Cars: Rare and classic cars that have historical or nostalgic value.

- Stamps and Coins: Philately (stamp collecting) and numismatics (coin collecting) have passionate communities of collectors and investors.

- Wine and Whisky: Rare and vintage bottles can fetch astronomical prices at auctions.

- Sports Memorabilia: Items associated with sports legends or significant moments in sports history.

Factors Influencing Value

- Provenance: The history of an item, including its previous owners and its origin, can significantly impact its value.

- Rarity: Items that are rare or limited in number often command higher prices.

- Condition: The state of preservation can greatly influence an item’s market value.

- Cultural or Historical Significance: Items associated with significant events or personalities can have enhanced value.

Digital Transformation: NFTs and Digital Collectibles

The digital age has introduced a new dimension to collectibles in the form of Non-Fungible Tokens (NFTs). These digital assets represent ownership of a unique item on the blockchain, ranging from digital art to virtual real estate and even tweets.

Bonds: The Steady Pillar of the Investment World

In the vast arena of investments, bonds have consistently stood as a cornerstone, offering stability and predictability amidst the tumultuous waves of market volatility. These debt securities, which represent loans made by investors to borrowers, play a crucial role in both individual portfolios and the broader financial system. This section delves into the intricacies of bonds, highlighting their characteristics, benefits, types, and their place in the modern investment landscape.

Understanding Bonds

At their core, bonds are essentially IOUs. When an investor purchases a bond, they are lending money to the issuer, be it a corporation, municipality, or government. In return, the issuer promises to pay periodic interest payments and return the bond’s face value upon maturity.

Types of Bonds

- Government Bonds: Issued by national governments, these are often considered low-risk investments. Examples include U.S. Treasury bonds and U.K. Gilts.

- Municipal Bonds: Issued by local governments or municipalities, often to fund public projects.

- Corporate Bonds: Issued by companies to raise capital for various business needs.

- Convertible Bonds: These can be converted into a predetermined number of the issuer’s equity shares.

Benefits of Investing in Bonds

- Stable Income: Bonds provide regular interest payments, offering a predictable income stream.

- Capital Preservation: Being debt instruments, bonds prioritize the return of the principal amount upon maturity.

- Diversification: Bonds can act as a counterbalance to the volatility of stock investments in a portfolio.

Factors Influencing Bond Prices

- Interest Rates: Bond prices typically move inversely to interest rates. When rates rise, bond prices tend to fall and vice versa.

- Credit Quality: Bonds issued by entities with higher credit ratings are considered less risky.

- Economic Indicators: Factors like inflation, economic growth, and geopolitical events can influence bond prices.

Risks Associated with Bonds

- Interest Rate Risk: As mentioned, bond prices can fluctuate with changes in interest rates.

- Credit Risk: The risk that the bond issuer might default on their interest payments or principal repayment.

- Reinvestment Risk: The risk that interest payments from bonds might be reinvested at a lower rate than the bond’s original rate.

The Role of Bond Markets

Bond markets, where bonds are issued and traded, play a pivotal role in determining interest rates and providing capital to issuers. Major bond markets include the New York Stock Exchange (NYSE) for corporate bonds and the Over-the-Counter (OTC) market for municipal bonds.

Conclusion

In the ever-evolving landscape of investments, diversification remains a cornerstone principle for mitigating risks and maximizing potential returns. As this comprehensive guide has illustrated, while stocks have long been the go-to for many investors, a myriad of alternative avenues exists, each offering its unique set of opportunities and challenges. From the tangible allure of real estate and the age-old trust in gold and silver to the digital frontier of cryptocurrencies and the community-driven power of equity crowdfunding, the investment world is as diverse as it is dynamic.

The key to successful investing lies not just in understanding these various assets but in aligning them with one’s financial goals, risk tolerance, and investment horizon. Whether it’s the steady income from bonds, the potential high returns of P2P lending, or the passion-driven investments in art and collectibles, each avenue requires thorough research, due diligence, and, often, a touch of intuition. As technology continues to redefine traditional systems and global events shape market dynamics, staying informed and adaptable is paramount.

In conclusion, the world of investments is a journey, one that is both challenging and rewarding. By broadening horizons beyond traditional stocks and venturing into alternative assets, investors not only stand to gain financially but also enrich their understanding of global economies, cultures, and innovations. As the future unfolds, these alternative investments will undoubtedly play a pivotal role in shaping the financial narratives of individuals and institutions alike.

Bitcoin-up is dedicated to providing fair and trustworthy information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More