Decoding Bitcoin Transactions: A Comprehensive Guide

Bitcoin, often represented by the symbol “₿”, is a decentralized digital currency that has taken the world by storm since its inception. Unlike traditional currencies issued by governments, Bitcoin operates on a peer-to-peer network, free from central authority or intermediaries. The essence of Bitcoin lies in its transactions, which are verified by network nodes through advanced cryptographic techniques and subsequently recorded in a public distributed ledger known as the blockchain.

The concept of Bitcoin was introduced in 2008 by an anonymous entity or group of individuals using the pseudonym Satoshi Nakamoto. The actual implementation of this revolutionary digital currency began in 2009 when its open-source software was released to the public. The term “bitcoin” is derived from two words: “bit” and “coin”, symbolizing its digital nature and its function as a medium of exchange.

Bitcoin’s decentralized nature has led to both admiration and criticism. While some countries have embraced it, others have imposed bans or restrictions. Notably, El Salvador has adopted Bitcoin as legal tender, marking a significant milestone in its history. However, the environmental impact of Bitcoin, particularly its energy-intensive mining process, has raised concerns among many.

Table: Key Facts about Bitcoin

| Feature | Description |

|---|---|

| Symbol | ₿ |

| Code | BTC or XBT |

| Precision | 10^−8 |

| Subunits | Millibitcoin, Microbitcoin, Satoshi |

| Original Author | Satoshi Nakamoto |

| White Paper | “Bitcoin: A Peer-to-Peer Electronic Cash System” |

| Initial Release | 9 January 2009 |

| Latest Release | 26 May 2023 |

| Ledger Start | 3 January 2009 |

| Hash Function | SHA-256 (two rounds) |

| Issuance Schedule | Decentralized (block reward) |

| Block Time | 10 minutes |

| Circulating Supply | ₿18,925,000 |

| Supply Limit | ₿21,000,000 |

Bitcoin’s significance extends beyond its monetary value. It represents a shift in the way we perceive money, transactions, and trust. By eliminating the need for intermediaries, Bitcoin offers a more transparent, secure, and potentially faster means of transferring value across the globe. However, to truly appreciate its potential, one must delve deep into the intricacies of Bitcoin transactions, which will be the focus of this guide.

The Anatomy of a Bitcoin Transaction

Every Bitcoin transaction is a digital message, signed by a cryptographic key, and broadcasted to the network for verification. At its core, a transaction is a transfer of value between Bitcoin wallets. Let’s dissect a typical Bitcoin transaction to understand its components.

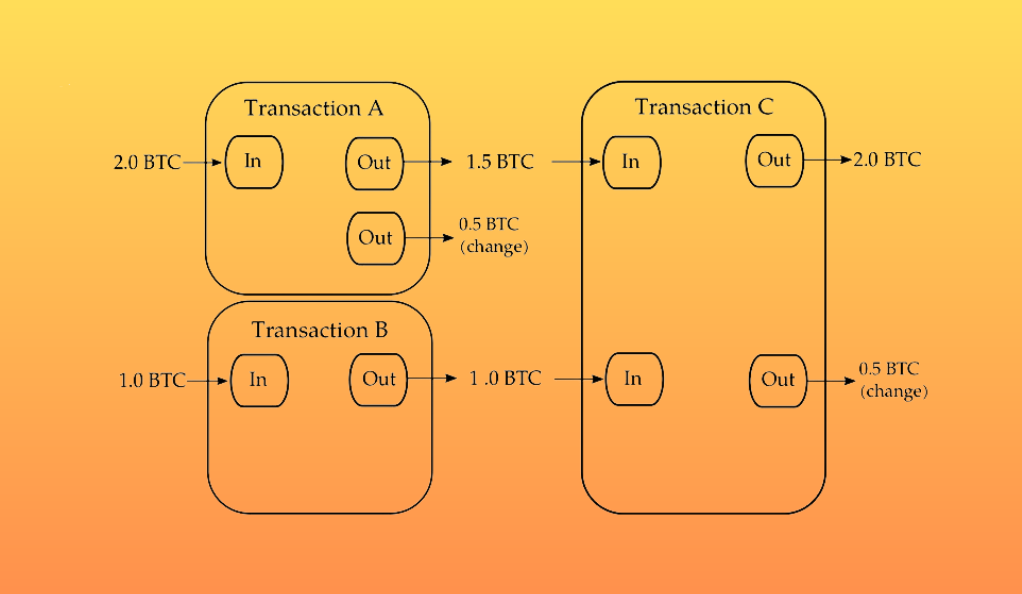

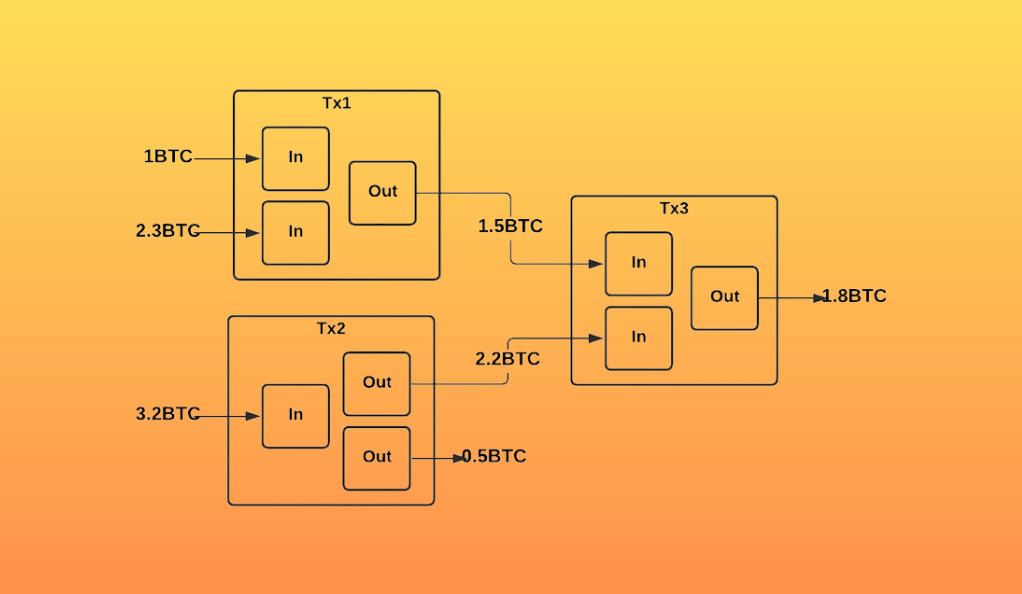

Transaction Inputs and Outputs

- Inputs: These are references to previous transactions’ outputs that the sender is using as a source of funds. Each input points to an output from a past transaction.

- Outputs: These determine where the bitcoins are being sent. Each output includes a Bitcoin address and the amount of bitcoins being sent to that address.

Example: If Alice sends 2 bitcoins to Bob, the input will reference a previous transaction where Alice received those bitcoins, and the output will specify Bob’s Bitcoin address and the amount of 2 bitcoins.

Transaction ID (TXID)

Every transaction has a unique identifier called the Transaction ID or TXID. It’s a string of numbers and letters that represents the transaction’s fingerprint. The TXID is generated by hashing the transaction details.

Signature

To ensure that only the rightful owner of the bitcoins can spend them, a digital signature is added to the transaction. This signature, created using the sender’s private key, proves the authenticity of the transaction.

Locktime

This optional component specifies the earliest time or block number when the transaction can be added to the blockchain. If locktime is not set, the transaction can be included in any block.

Table: Components of a Bitcoin Transaction

| Component | Description |

|---|---|

| Inputs | References to previous transaction outputs |

| Outputs | Specifies the recipient’s address and amount |

| TXID | Unique identifier for the transaction |

| Signature | Digital proof of transaction authenticity |

| Locktime | Specifies when the transaction can be added to the blockchain |

Transaction Fees

Bitcoin transactions aren’t free. Users pay a fee to incentivize miners to include their transactions in the blockchain. The fee is not fixed and varies based on the transaction’s size and network congestion. Typically, if you pay a higher fee, your transaction will be processed faster.

Confirmations

Once a transaction is broadcasted to the network, it gets picked up by miners and added to a block. After the block is added to the blockchain, the transaction receives one confirmation. With each subsequent block added, the number of confirmations increases, making the transaction more secure against double-spending attacks.

UTXOs (Unspent Transaction Outputs)

The UTXO model is fundamental to grasping how Bitcoin transactions work. Unlike traditional banking systems where balances are directly recorded, Bitcoin uses a system of inputs and outputs to determine wallet balances.

What is UTXO?

UTXO stands for Unspent Transaction Output. In simple terms, it’s the amount of bitcoin remaining after a transaction has been executed, which can be used as an input in a future transaction. Think of it as the change you receive after making a purchase; you can use that change for subsequent purchases.

The Lifecycle of a UTXO

- Creation: A UTXO is created whenever a Bitcoin transaction occurs. The recipient gets a new UTXO, which represents the bitcoins they’ve just received.

- Consumption: When the recipient uses those bitcoins in a new transaction, the UTXO is used as an input and is thus “spent.”

- Generation of New UTXOs: The same transaction will generate new UTXOs for the next recipient, and possibly a change UTXO for the sender if they didn’t spend all their bitcoins.

Why UTXOs Matter?

- Transparency and Security: The UTXO model ensures that all bitcoins in a transaction are accounted for. This makes double-spending nearly impossible, as every UTXO can only be spent once.

- Parallel Processing: UTXOs allow for multiple transactions to be processed in parallel, enhancing the scalability and speed of the Bitcoin network.

- Privacy: While all transactions are public on the blockchain, UTXOs provide a level of privacy by not directly associating transaction outputs with individuals until they’re spent.

Table: UTXO vs. Account/Balance Model

| Feature | UTXO Model | Account/Balance Model |

|---|---|---|

| Tracking | Tracks individual transaction outputs | Tracks total balance |

| Double-Spending | Nearly impossible due to UTXO uniqueness | Requires additional mechanisms |

| Scalability | High due to parallel processing | Varies based on system |

| Privacy | Enhanced by not linking outputs to individuals | Directly links accounts to individuals |

Managing UTXOs

For Bitcoin wallet holders, managing UTXOs is crucial. Holding a large number of small UTXOs can lead to higher transaction fees, as the size of a transaction (in bytes) increases with more inputs. Some wallets offer “coin selection” features, allowing users to optimize which UTXOs to spend in a transaction to minimize fees.

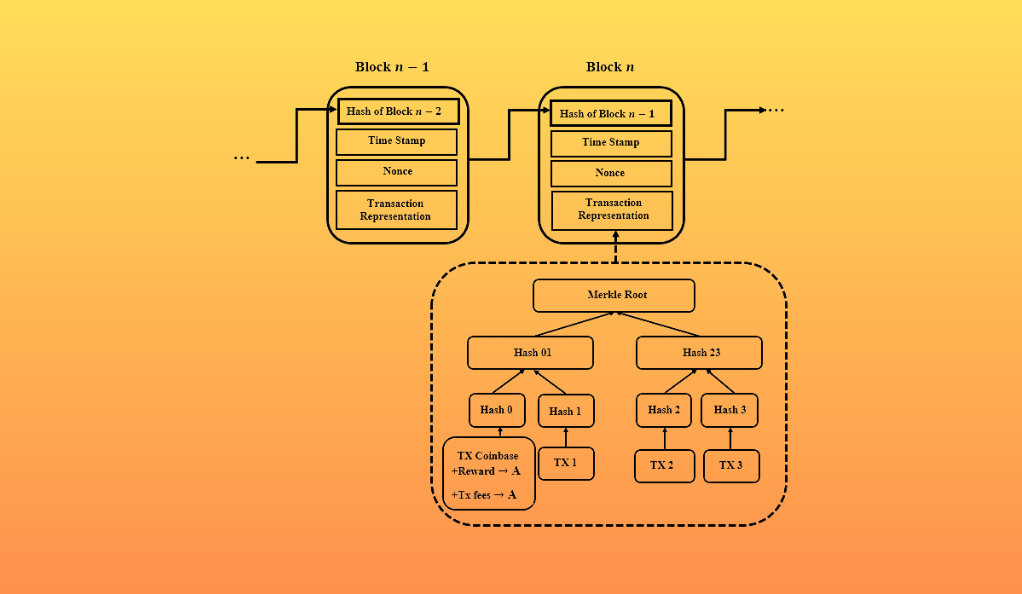

The Unique Structure of Bitcoin Blockchain Data

The Bitcoin blockchain is a decentralized ledger that chronologically records all Bitcoin transactions. Its design is a marvel of cryptographic innovation, ensuring data integrity, transparency, and resistance to censorship. Let’s explore the intricacies of this structure.

Blocks and the Chain

- Blocks: Each block contains a collection of transactions, a reference to the previous block (known as the previous block hash), and a proof of work. The block also has a unique identifier called the block hash.

- The Chain: The blockchain is essentially a chain of blocks. Each new block references the previous one, creating a continuous, unbroken chain back to the very first block, known as the Genesis Block.

Proof of Work (PoW)

Proof of Work is a consensus mechanism that requires participants (miners) to solve complex mathematical problems to validate and add new transactions to the blockchain. This process:

- Ensures security: Making fraudulent changes becomes computationally expensive and practically infeasible.

- Regulates block creation: On average, a new block is added every 10 minutes.

Merkle Trees

Inside each block, transactions are structured in a Merkle Tree – a binary tree of hashes. This structure:

- Allows for efficient and secure verification of transaction contents.

- Ensures that even the smallest change in a transaction will result in a completely different tree.

Immutable Nature

Once a block is added to the blockchain:

- Altering its content would change its hash, breaking the chain’s continuity.

- To make a change, one would have to redo the PoW for that block and all subsequent blocks, which is computationally infeasible given the cumulative work done by the entire network.

Table: Key Features of Bitcoin’s Blockchain

| Feature | Description |

|---|---|

| Block Time | Approximately 10 minutes |

| Consensus Mechanism | Proof of Work |

| Data Structure | Merkle Trees |

| Immutability | Once added, data cannot be altered without breaking the chain |

Decentralization and Security

The Bitcoin blockchain is maintained by a decentralized network of nodes. This decentralization:

- Eliminates single points of failure.

- Makes the network resistant to censorship and external attacks.

- Ensures data integrity and transparency, as every node has a copy of the entire blockchain.

Scalability Challenges

While the blockchain’s design ensures security and decentralization, it poses challenges in scalability. The fixed block size and block time can lead to congestion, especially during periods of high transaction volume. Solutions like the Lightning Network and Segregated Witness (SegWit) have been proposed and implemented to address these challenges.

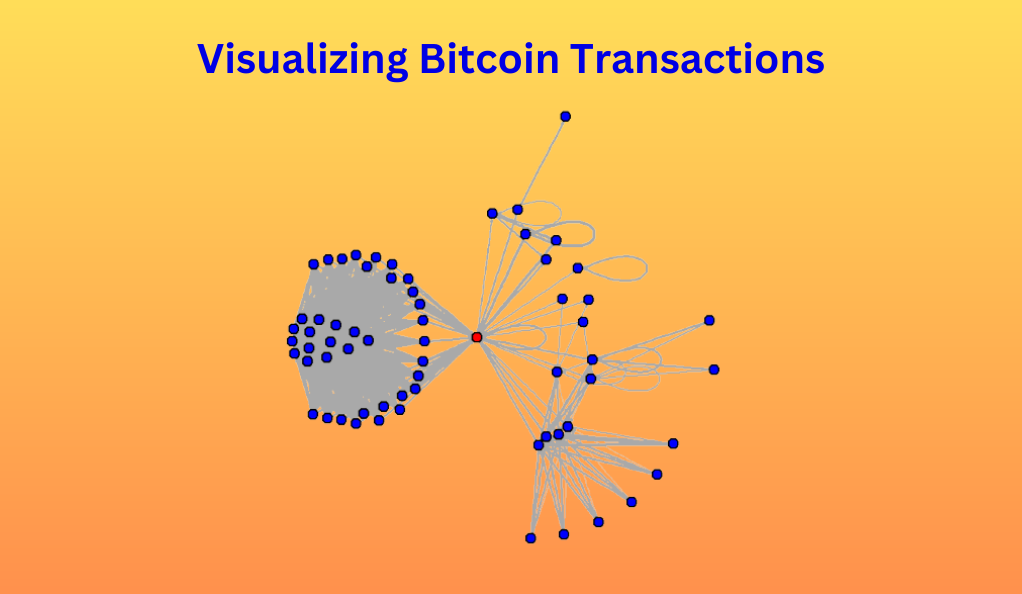

Visualizing Bitcoin Transactions

The vast and intricate world of Bitcoin transactions, while primarily numerical and cryptographic, can be visualized to provide clearer insights, detect patterns, and make the data more accessible to a broader audience. This section delves into the tools and techniques used to visualize Bitcoin transactions.

The Importance of Visualization

- Accessibility: Visualization transforms complex transaction data into easily digestible visuals, making it more approachable for non-experts.

- Pattern Recognition: Visual representations can help identify trends, anomalies, and patterns in transaction data that might be challenging to discern from raw data.

- Decision Making: For traders, investors, and researchers, visual data can aid in making informed decisions.

Transaction Graphs

One of the primary methods to visualize Bitcoin transactions is through transaction graphs. In these graphs:

- Nodes represent addresses.

- Edges represent transactions between these addresses.

By analyzing these graphs, one can identify clusters of addresses, frequent transaction paths, and even potential centralized hubs.

Heat Maps

Heat maps provide a visual representation of transaction activity over a specific period or within certain regions. They can highlight:

- Peak Transaction Times: Identify when transaction activity is at its highest.

- Geographical Analysis: Determine regions with the most Bitcoin activity.

Block Explorers

Block explorers are online tools that allow users to explore individual blocks, transactions, and addresses in the Bitcoin blockchain. They provide:

- Detailed Transaction Data: Including inputs, outputs, fees, and confirmations.

- Visual Representations: Some offer graphical views of transaction flows and block connections.

Popular block explorers include Blockchair, BTC.com, and Blockchain.info.

Time Series Analysis

By plotting transaction values, fees, or confirmation times against time, one can identify trends, spikes, or anomalies in the Bitcoin network’s activity over specific durations.

3D Visualization Tools

Advanced tools allow for 3D visualizations of the blockchain, offering a multi-dimensional view of transaction data. These tools can represent:

- Block Connections: Show how blocks are linked in the chain.

- Transaction Depths: Highlight the depth or number of confirmations of specific transactions.

Bitcoin’s Security and Scalability

Bitcoin’s rise to prominence is not just due to its decentralized nature or its potential as a digital currency. At its core, the security mechanisms embedded within its framework have played a pivotal role in its adoption. However, with increased adoption comes the challenge of scalability. This section delves into the balance between security and scalability in the Bitcoin network.

Cryptographic Security

- Public and Private Keys: Every Bitcoin wallet has a public key, which is like an address that others can see, and a private key, which is known only to the wallet owner. The private key is used to sign transactions and prove ownership, while the public key is used to verify the signature.

- Hash Functions: Bitcoin uses the SHA-256 cryptographic hash function. It ensures that transaction data is secure and tamper-proof. Any slight change in the input results in a drastically different hash, making alterations easily detectable.

Decentralized Consensus

- Proof of Work (PoW): As discussed earlier, PoW requires miners to solve complex mathematical problems, ensuring that block additions are costly and time-consuming. This mechanism deters malicious activities.

- Node Verification: Every transaction is verified by nodes in the network. A transaction is considered valid only if it adheres to the consensus rules set by the network.

Double-Spending Prevention

One of the significant challenges any digital currency faces is the risk of double-spending. Bitcoin addresses this by:

- Confirmations: A transaction becomes more secure with each confirmation. The more blocks added after the transaction block, the harder it becomes to reverse it.

- Consensus: Since the network must agree on the blockchain’s state, any attempt to double-spend would require altering the majority of ledgers across the network, which is computationally infeasible.

Scalability Challenges and Solutions

As Bitcoin’s popularity grew, so did the number of transactions, leading to scalability issues. Solutions include:

- Segregated Witness (SegWit): Implemented in 2017, SegWit separates transaction signatures from transaction data, effectively reducing the size of transactions and allowing more to fit within a block.

- Lightning Network: A second-layer solution that enables off-chain transactions. It allows users to create payment channels and transact without recording every transaction on the blockchain, settling the net amounts when the channel is closed.

- Block Size Adjustments: Proposals have been made to increase the block size, allowing more transactions per block. However, this remains a contentious issue within the community.

Table: Bitcoin’s Security vs. Scalability

| Aspect | Security Features | Scalability Solutions |

|---|---|---|

| Key Management | Public/Private Key Cryptography | N/A |

| Transaction Verification | SHA-256 Hashing | SegWit |

| Consensus | Proof of Work | Lightning Network |

| Double-Spending | Multiple Confirmations | N/A |

| Transaction Volume | N/A | Block Size Adjustments |

The Economic Implications of Bitcoin Transactions

Bitcoin, initially conceptualized as a peer-to-peer electronic cash system, has evolved into a multifaceted financial asset with profound economic implications. Its decentralized nature, combined with its global reach, has positioned it uniquely in the financial landscape. This section delves into the economic ramifications of Bitcoin transactions.

Bitcoin as a Store of Value

- Digital Gold: Many have likened Bitcoin to gold, dubbing it “digital gold.” Like gold, Bitcoin is scarce (with a capped supply of 21 million), and its decentralized nature makes it resistant to external controls, such as government interventions.

- Hedge Against Inflation: In economies experiencing inflation or hyperinflation, Bitcoin has become a refuge for many, preserving wealth as local currencies devalue.

Bitcoin as a Medium of Exchange

- Cross-border Transactions: Bitcoin facilitates international transactions without the need for currency conversions or traditional banking systems, often resulting in faster and cheaper transfers.

- Financial Inclusion: For those without access to traditional banking systems, especially in developing nations, Bitcoin offers an opportunity to participate in the global economy.

Bitcoin as a Unit of Account

While not widespread, some businesses and online platforms price their goods and services in Bitcoin. This is especially prevalent in sectors that prioritize privacy or operate primarily in the cryptocurrency ecosystem.

Impact on Traditional Banking

- Disintermediation: Bitcoin’s peer-to-peer nature reduces the need for intermediaries, potentially reshaping the banking and financial services landscape.

- New Financial Products: The rise of Bitcoin has led to the creation of various financial products, including Bitcoin futures, ETFs, and lending platforms.

Regulatory and Tax Implications

- Regulatory Landscape: Governments worldwide are grappling with how to regulate Bitcoin. While some nations have embraced it, others have imposed strict regulations or outright bans.

- Taxation: Many tax authorities treat Bitcoin as property, meaning capital gains tax applies to its sale. However, the decentralized nature of Bitcoin poses challenges for tax enforcement.

Environmental Concerns

The energy-intensive process of Bitcoin mining has raised environmental concerns. The Proof of Work consensus mechanism, while secure, requires significant computational power, leading to debates about its carbon footprint.

Table: Economic Facets of Bitcoin

| Aspect | Implications |

|---|---|

| Store of Value | Hedge against inflation, wealth preservation |

| Medium of Exchange | Facilitates global transactions, financial inclusion |

| Unit of Account | Pricing goods and services in Bitcoin |

| Banking Impact | Potential disruption, emergence of new financial products |

| Regulation | Diverse global regulatory landscape, taxation challenges |

| Environment | Carbon footprint concerns due to energy-intensive mining |

Common Misconceptions about Bitcoin Transactions

As with any revolutionary technology, Bitcoin, despite its growing adoption, is surrounded by myths, misunderstandings, and misconceptions. These often arise from a lack of knowledge, skepticism, or misinformation. This section aims to debunk some of these myths and provide clarity on Bitcoin transactions.

Bitcoin is Anonymous

Bitcoin is pseudonymous, not anonymous. Every transaction is recorded on the public ledger, the blockchain. While names and personal details aren’t directly linked, with enough analysis, Bitcoin addresses can potentially be traced back to individuals or organizations.

Bitcoin Transactions are Instant

While Bitcoin transactions are broadcasted to the network almost instantly, they require confirmations to be considered secure. On average, a confirmation takes about 10 minutes, though this can vary based on network congestion.

Bitcoin is Free to Use

While there’s no cost to own or hold Bitcoin, transactions usually incur fees. These fees compensate miners for validating and recording transactions on the blockchain.

Bitcoin Transactions are Irreversible

Technically, this is true. Once a transaction is confirmed, it cannot be undone. However, if both parties agree, a new transaction can be made to reverse the effects of the original one.

Bitcoin is Only Used for Illegal Activities

While Bitcoin has been used in illicit activities due to its pseudonymous nature, the vast majority of Bitcoin transactions are for legitimate purposes. Many businesses accept Bitcoin, and it’s also used for investment, remittances, and other legal activities.

All Bitcoin Transactions are Public, So Everyone Can See My Balance

While all transactions are public, they’re linked to Bitcoin addresses, not personal identities. Unless someone knows which addresses belong to you, they can’t determine your balance. However, once an address is linked to an identity, all transactions involving that address become tied to that identity.

Bitcoin is Not Secure Because It’s Digital

Bitcoin employs advanced cryptographic techniques, making it incredibly secure. The decentralized nature of its network further enhances its security, making attacks computationally challenging and expensive.

Table: Debunking Bitcoin Myths

| Misconception | Reality |

|---|---|

| Bitcoin is Anonymous | It’s pseudonymous; transactions can potentially be traced. |

| Transactions are Instant | They require confirmations, averaging 10 minutes each. |

| Bitcoin is Free | Transactions incur fees to compensate miners. |

| Transactions are Irreversible | True, but effects can be reversed with a new transaction. |

| Used Only for Illicit Activities | Majority of transactions are legitimate. |

| All Transactions are Public | They’re linked to addresses, not identities. |

| Bitcoin is Insecure | It employs advanced cryptography and a decentralized network. |

Conclusion

Bitcoin, a pioneering force in the realm of digital currencies, has reshaped our understanding of money, transactions, and the very fabric of the financial world. Its decentralized nature, combined with robust cryptographic security, offers a transparent and immutable system, standing as a testament to the power of innovation. As we’ve journeyed through the intricacies of Bitcoin transactions, from their basic structure to their broader economic implications, it’s evident that Bitcoin is more than just a digital asset; it’s a revolution in the financial landscape.

However, with innovation comes the responsibility of understanding. As users, traders, or mere enthusiasts, it’s imperative to dispel myths, grasp the underlying mechanisms, and approach Bitcoin with an informed perspective. The world of Bitcoin is vast, and while we’ve delved deep into its transactional anatomy, there remains a universe of knowledge waiting to be explored. The ever-evolving nature of Bitcoin ensures that its journey is far from over, and its impact on future financial systems, economies, and global transactions is bound to be profound.

In closing, as we stand at the crossroads of traditional finance and the digital frontier, Bitcoin offers a glimpse into a future where autonomy, transparency, and security reign supreme. Embracing this future requires not just adoption, but education, understanding, and a commitment to exploring the depths of this transformative technology. The story of Bitcoin is still being written, and each of us has a role to play in its unfolding narrative.

Bitcoin-up is dedicated to providing fair and trustworthy information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More