Why Bonds Are Still Essential Investments: A Comprehensive Guide

Introduction: The Timeless Significance of Bonds

Bonds, often referred to as fixed-income securities, have been a cornerstone of the financial world for centuries. Their origins can be traced back to the Renaissance period when city-states and kingdoms issued debt instruments to fund wars, infrastructure projects, and other ventures. Today, bonds remain a vital component of the global financial system, offering both individual and institutional investors a reliable source of income and a means to diversify their portfolios.

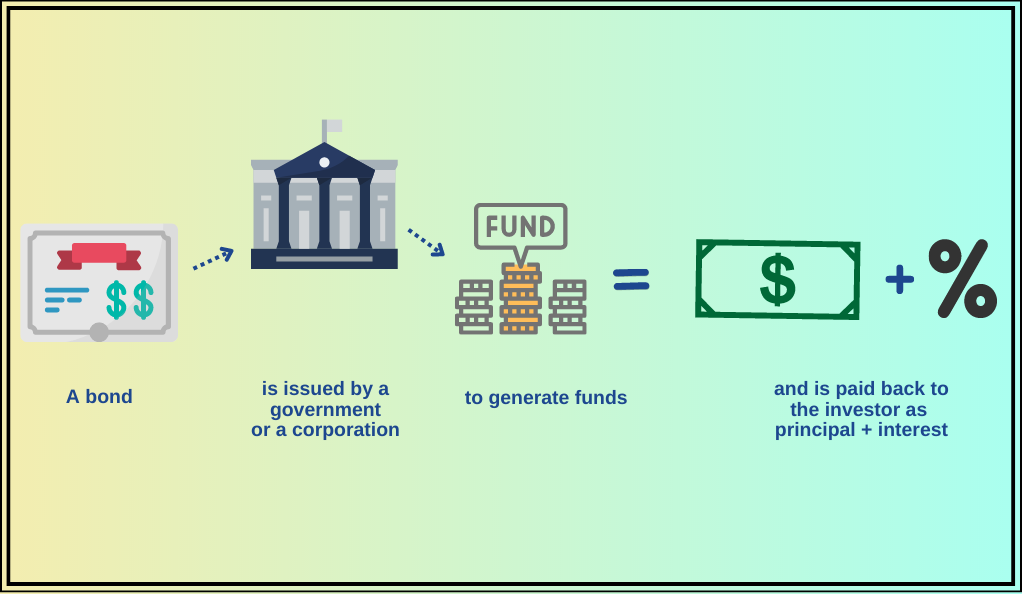

What is a Bond?

At its core, a bond is a loan made by an investor to a borrower, typically a corporation or government entity. In return for the loan, the borrower agrees to pay the investor periodic interest payments, known as coupon payments, and to return the principal amount, or face value, of the bond at a specified maturity date.

Key Terminologies in the Bond Market

| Term | Definition |

|---|---|

| Principal | The initial amount of money invested or loaned, which will be returned upon the bond’s maturity. |

| Coupon Rate | The interest rate that the bond issuer will pay to the bondholder. |

| Maturity Date | The date on which the bond will mature, and the principal amount will be returned to the investor. |

| Yield | The rate of return on a bond, calculated based on its price and its coupon rate. |

| Credit Rating | An assessment of the creditworthiness of a bond issuer. |

Bonds vs. Stocks: A Brief Comparison

While both bonds and stocks represent investment opportunities, they come with distinct characteristics and risk profiles.

| Criteria | Bonds | Stocks |

|---|---|---|

| Nature | Debt instruments. | Ownership instruments. |

| Returns | Fixed interest payments (coupons) and principal repayment at maturity. | Dividends (not guaranteed) and potential capital appreciation. |

| Risk | Generally lower risk. Default risk depends on the issuer’s creditworthiness. | Higher risk. Value can fluctuate based on company performance, market conditions, etc. |

| Duration | Fixed maturity date. | Indefinite. |

| Influence | Bondholders do not have voting rights in the company. | Stockholders may have voting rights, influencing company decisions. |

The Evergreen Appeal of Bonds

Despite the allure of potentially higher returns from other investment avenues like stocks or real estate, bonds have maintained their appeal for several reasons:

- Predictability: Bonds offer a predictable stream of income through their coupon payments.

- Safety: Especially in the case of government bonds, there’s a high level of security as governments are unlikely to default on their debt.

- Diversification: Bonds can act as a counterbalance in a portfolio, especially during stock market downturns.

The Diversification Power of Bonds

In the world of investments, diversification is a strategy that can’t be stressed enough. By spreading investments across various asset classes, investors can mitigate risks associated with any single asset. Bonds, with their unique characteristics, play a pivotal role in this diversification strategy.

Why Diversification Matters

Diversification is akin to the age-old adage, “Don’t put all your eggs in one basket.” In investment terms, this means not concentrating your money in a single asset or asset class. The primary reasons for diversification include:

- Risk Reduction: Different assets respond differently to market events. While one asset might be declining in value, another might be increasing or remaining stable.

- Potential for Higher Returns: By diversifying, investors can position themselves to capitalize on the performance of the best-performing assets.

- Preservation of Capital: Diversification can help protect the initial investment amount, especially crucial for those nearing retirement or with shorter investment horizons.

Bonds as a Counterbalance

Stocks and bonds often have an inverse relationship. When stock prices fall, bond prices tend to rise, and vice versa. This inverse correlation offers a safety net for investors.

Stock-Bond Correlation Over the Years

| Year | Stock Performance | Bond Performance | Correlation |

|---|---|---|---|

| 2018 | -4.5% | +2.9% | Inverse |

| 2019 | +28.9% | +8.7% | Direct |

| 2020 | +16.3% | +7.5% | Direct |

| 2021 | +12.5% | -1.2% | Inverse |

Note: The above figures are hypothetical and for illustrative purposes only.

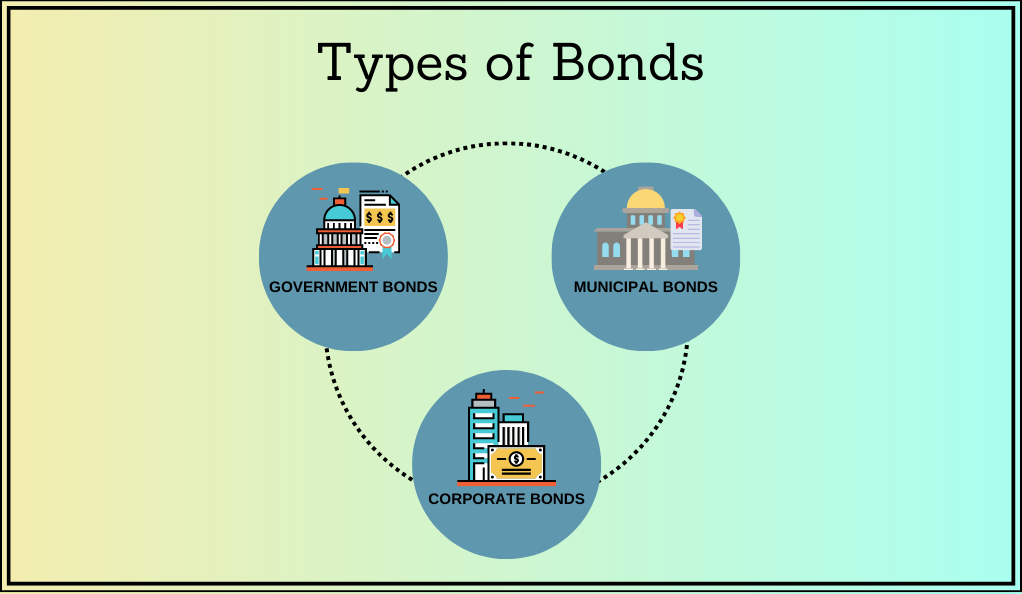

Types of Bonds and Their Roles in Diversification

Different bonds come with varying levels of risk and return, further aiding in the diversification process:

- Government Bonds: Issued by national governments, these are often deemed the safest. They are especially sought after during turbulent economic times.

- Corporate Bonds: Issued by companies, these bonds come with higher yields due to the increased risk compared to government bonds.

- Municipal Bonds: Issued by local governments or municipalities, these often offer tax benefits to investors.

- High-Yield Bonds: Also known as junk bonds, they offer higher interest rates due to their higher risk of default.

In a diversified portfolio, bonds act as a stabilizing force, cushioning against the volatile swings of the stock market. Their predictable income stream, combined with capital preservation, makes them an essential tool for both novice and seasoned investors. As we navigate the complexities of the financial world, the timeless value of bonds remains evident.

Safety and Security: The Dual Nature of Bonds

When discussing investments, the terms “safety” and “security” are often used interchangeably. However, in the context of bonds, they take on distinct meanings. Understanding this distinction is crucial for investors to make informed decisions.

Collateral and Security Types

Bonds can be either secured or unsecured:

- Secured Bonds: These are backed by specific assets or collateral. If the issuer defaults, the assets can be liquidated to repay bondholders. Examples include mortgage bonds backed by real estate.

- Unsecured Bonds: Also known as debentures, these are not backed by any collateral. Instead, they rely on the issuer’s general creditworthiness. They typically come with higher yields to compensate for the increased risk.

The Paradox of Safety and Yield

A fundamental principle in finance is the risk-return trade-off. Generally, the safer the bond, the lower its yield, and vice versa. While government bonds are considered safe and offer lower yields, high-yield or “junk” bonds come with higher risks but offer attractive returns.

For investors, the choice between safety and yield depends on their risk tolerance, investment goals, and time horizon. By understanding the nuances of safety and security in bonds, investors can make more informed decisions, striking the right balance between risk and return.

Interest Rates and Bond Sensitivity: The Delicate Dance

Interest rates play a pivotal role in the financial markets, influencing everything from consumer loans to massive corporate investments. For bonds, interest rates are particularly significant, dictating their pricing, yield, and overall attractiveness in the investment landscape.

The Inverse Relationship: Bond Prices and Interest Rates

One of the foundational concepts in bond investing is the inverse relationship between bond prices and interest rates:

- When interest rates rise, new bonds issued will typically offer higher yields to attract investors. As a result, existing bonds with lower yields become less attractive, leading to a decrease in their prices.

- When interest rates fall, existing bonds with higher yields become more attractive compared to newly issued bonds. This increased demand drives up the prices of existing bonds.

Duration: Measuring Bond Sensitivity to Interest Rates

Duration is a measure used to estimate how much a bond’s price will change in response to a one percent change in interest rates. It provides investors with a tool to assess the potential volatility of their bond investments.

- Short Duration: Bonds that mature quickly are less sensitive to interest rate changes. They offer lower potential returns but also lower risk.

- Long Duration: Bonds with longer maturities are more sensitive to interest rate fluctuations. They can offer higher returns but come with increased risk.

Duration and Interest Rate Sensitivity

| Duration | Estimated Price Change for a 1% Interest Rate Increase | Estimated Price Change for a 1% Interest Rate Decrease |

|---|---|---|

| 2 years | -2% | +2% |

| 5 years | -5% | +5% |

| 10 years | -10% | +10% |

| 20 years | -20% | +20% |

Note: These are approximate values and actual changes can vary based on various factors.

Yield Curve: A Predictor of Economic Health

The yield curve plots the yields of bonds with similar credit quality but different maturities. Its shape can provide insights into future interest rate movements and economic outlook:

- Normal Yield Curve: Longer-term bonds have higher yields than short-term bonds, indicating economic expansion.

- Inverted Yield Curve: Short-term bonds yield more than long-term bonds, often seen as a predictor of economic downturns.

- Flat Yield Curve: Yields are similar across maturities, indicating economic uncertainty.

Understanding the dynamics of interest rates is crucial for bond investors. As rates fluctuate, they directly impact bond prices, yields, and investment strategies. By staying informed and adapting to the ever-changing interest rate environment, investors can optimize their bond portfolios, balancing risk and reward in the pursuit of financial goals.

Exploring the Diverse World of Bond Types

The bond market, vast and varied, offers a plethora of options for investors. Each bond type comes with its unique set of characteristics, risk profiles, and potential returns. By understanding these nuances, investors can tailor their portfolios to meet specific financial objectives and risk tolerances.

Government Bonds: The Gold Standard of Safety

Often deemed the safest bonds, government bonds are issued by national governments. They are primarily used to finance public projects and manage national debt.

- Treasury Bonds (T-Bonds): Long-term securities with maturities ranging from 10 to 30 years. They offer fixed interest payments and are backed by the full faith and credit of the government.

- Treasury Notes (T-Notes): Medium-term securities with maturities between 2 and 10 years.

- Treasury Bills (T-Bills): Short-term securities maturing in one year or less. They are sold at a discount and do not pay interest; instead, the return is the difference between the purchase price and the face value.

Corporate Bonds: Venturing into the Private Sector

Issued by companies to raise capital for various purposes, corporate bonds typically offer higher yields than government bonds, compensating for the added risk.

- Investment-Grade Bonds: These have high credit ratings, indicating a lower risk of default. They offer moderate yields and are favored by conservative investors.

- High-Yield Bonds: Also known as “junk bonds,” these have lower credit ratings and come with a higher risk of default. However, they offer attractive yields, appealing to risk-tolerant investors.

Municipal Bonds: Investing in Local Projects

Issued by local governments, municipalities, or other public entities, municipal bonds finance public projects like schools, hospitals, and infrastructure.

- General Obligation Bonds (GOs): Backed by the full faith and credit of the issuing municipality. They are repaid from general funds, including tax revenues.

- Revenue Bonds: Repaid from the revenues generated by the specific project they finance, such as toll roads or airports.

International and Emerging Market Bonds: Broadening Horizons

For investors looking to diversify beyond domestic markets, international bonds offer exposure to global economies.

- Sovereign Bonds: Issued by foreign governments, these bonds provide a window into the economic health and policies of other nations.

- Emerging Market Bonds: Issued by countries with developing economies, they come with higher risks but can offer substantial returns.

With a myriad of bond types available, investors can craft portfolios that align with their financial goals, whether it’s capital preservation, income generation, or growth. By diversifying across different bond types and maturities, investors can navigate market uncertainties, harnessing the power of bonds to achieve stable and consistent returns.

Strategies for Bond Investing: Navigating the Fixed-Income Landscape

Bond investing, while perceived as straightforward, requires a strategic approach to maximize returns and minimize risks. Whether you’re a novice investor or a seasoned financial expert, understanding the intricacies of bond strategies can significantly enhance your investment outcomes.

Active vs. Passive Bond Management

At the heart of bond investing lies a fundamental decision: to actively manage your bond portfolio or to adopt a passive approach.

- Active Management: Involves regularly buying and selling bonds based on market analysis, economic forecasts, and issuer creditworthiness. The goal is to outperform a specific bond index or benchmark.

- Passive Management: Focuses on replicating the performance of a bond index by holding a diversified portfolio of bonds that mirror the index. It’s a set-it-and-forget-it approach, with minimal buying and selling.

Laddering: Spreading Maturities Over Time

A bond ladder involves purchasing a series of bonds with staggered maturities. As each bond matures, the proceeds are reinvested in a new bond at the longest maturity of the ladder.

Benefits:

- Provides a consistent income stream.

- Reduces the impact of interest rate fluctuations.

- Offers flexibility to reinvest in higher-yielding bonds if interest rates rise.

Barbelling: Balancing Short and Long-Term Bonds

This strategy involves investing heavily in short-term and long-term bonds while minimizing exposure to medium-term bonds. The portfolio’s shape resembles a barbell, with concentrations on both ends.

Advantages:

- Short-term bonds offer liquidity and lower interest rate risk.

- Long-term bonds provide higher yields.

- Flexibility to adjust based on interest rate predictions.

Bullet Strategy: Targeting a Specific Maturity Date

In the bullet strategy, an investor purchases bonds that all mature around the same time. It’s particularly useful for investors with a known future cash need, like college tuition or a home purchase.

Riding the Yield Curve: Capitalizing on Curve Dynamics

Investors can benefit from the typical upward-sloping shape of the yield curve. By buying bonds with maturities longer than their investment horizons and selling them before they mature, investors can potentially earn higher yields without holding the bond to maturity.

The world of bond investing is rich with opportunities for those willing to delve deep and strategize. By understanding the various investment approaches and aligning them with personal financial goals and risk tolerance, investors can harness the full potential of bonds. Whether seeking regular income, capital appreciation, or portfolio diversification, a well-thought-out bond strategy can pave the way for financial success.

Advanced Bond Concepts: Delving Deeper into the Bond Market Dynamics

While the foundational principles of bond investing are essential, diving into advanced concepts can provide investors with a more nuanced understanding of bond market dynamics. These concepts can be instrumental in refining investment strategies and navigating the complexities of the fixed-income landscape.

Convexity: Beyond Duration

While duration provides a linear estimate of a bond’s price sensitivity to interest rate changes, convexity adds another layer by accounting for the curvature in the bond’s price-yield curve.

- Positive Convexity: As interest rates decrease, bond prices increase at an accelerating rate. Conversely, as rates increase, bond prices decrease at a decelerating rate. This characteristic is generally favorable for bondholders.

- Negative Convexity: Opposite of positive convexity, it’s less common and usually seen in callable bonds.

Understanding convexity can help investors better predict bond price movements in volatile interest rate environments.

Inflation and Its Impact on Bonds

Inflation erodes the purchasing power of money over time. For bond investors, this can be a significant concern, especially for long-term bonds.

- Real vs. Nominal Yield: The nominal yield is the interest rate stated on the bond, while the real yield adjusts this rate for inflation. If a bond has a nominal yield of 5% and inflation is 2%, the real yield is approximately 3%.

- Inflation-Protected Securities: Some bonds, like the U.S. Treasury Inflation-Protected Securities (TIPS), offer protection against inflation. The principal value of TIPS adjusts with inflation, ensuring that investors’ purchasing power remains intact.

Callable and Puttable Bonds: Adding Flexibility

Some bonds come with embedded options that provide additional flexibility:

- Callable Bonds: The issuer has the right to “call” or redeem the bond before its maturity date. This is typically done when interest rates fall, allowing the issuer to refinance at a lower rate. While callable bonds offer higher yields, they come with reinvestment risk for investors.

- Puttable Bonds: These give bondholders the option to “put” or sell the bond back to the issuer before maturity. This feature is beneficial for investors if interest rates rise, allowing them to reinvest at higher rates.

Credit Spread: Gauging Default Risk

The credit spread represents the yield difference between bonds of similar maturity but different credit quality. A wider spread indicates a higher perceived risk of default for the bond issuer. Monitoring credit spreads can provide insights into market sentiment and the overall health of the economy.

The Global Bond Landscape: Navigating International Waters

In today’s interconnected world, the bond market extends far beyond domestic borders. International bonds, influenced by a myriad of geopolitical events, monetary policies, and global economic trends, offer investors a chance to diversify, tap into emerging markets, and potentially reap higher returns. However, with these opportunities come unique challenges and risks.

Sovereign Bonds: A Glimpse into National Economies

Sovereign bonds, issued by national governments, are a reflection of a country’s economic health and stability. They offer insights into:

- Creditworthiness: International credit rating agencies rate countries based on their ability to repay debt, providing a snapshot of their economic stability.

- Economic Policies: Sovereign bond yields can indicate market sentiment towards a country’s fiscal and monetary policies.

- Currency Strength: Foreign exchange rates play a crucial role in determining the returns from international bonds for foreign investors.

Emerging Market Bonds: High Risk, High Reward

Emerging markets, characterized by rapid industrialization and higher growth rates, offer lucrative opportunities for bond investors. However, they also come with heightened risks:

- Economic Volatility: Emerging economies can be more susceptible to economic downturns, affecting their ability to honor bond obligations.

- Political Instability: Changes in leadership or political unrest can impact a country’s creditworthiness and, consequently, bond prices.

- Currency Fluctuations: Emerging market currencies can be volatile, impacting returns for foreign investors.

Supranational Bonds: Beyond Borders

Supranational organizations, like the World Bank or the European Union, also issue bonds. The proceeds often fund development projects across multiple countries. These bonds:

- Offer a level of diversification as they aren’t tied to a single country’s economy.

- Typically have high credit ratings due to the collective backing of member countries.

Global Corporate Bonds: Tapping into International Corporates

Multinational corporations, operating in multiple countries, issue bonds to raise capital in various currencies. Investing in these bonds allows exposure to:

- Diverse Industries: From tech giants in Silicon Valley to automobile manufacturers in Germany.

- Currency Diversification: Corporations issue bonds in various currencies, offering a hedge against currency risks.

Risks in International Bond Investing

While the allure of higher returns is tempting, international bond investing comes with its set of challenges:

- Exchange Rate Risk: Fluctuations in currency values can impact returns.

- Liquidity Risk: Some international bonds might not be as liquid as domestic ones, making buying or selling challenging.

- Regulatory and Tax Implications: Different countries have varying regulations and tax structures that can impact returns.

The global bond landscape, with its vast opportunities and inherent challenges, requires a well-thought-out strategy. By understanding the dynamics of international markets, staying updated on geopolitical events, and diversifying across regions and currencies, investors can navigate the complexities of the global bond market. As the world continues to evolve, so too will the opportunities within the international fixed-income realm.

Conclusion: Navigating the Complex Tapestry of Bond Investing

The world of bond investing, with its intricate weave of domestic and international threads, presents both challenges and opportunities for investors. From the foundational principles of bond dynamics to the nuanced strategies of global bond markets, understanding the multifaceted nature of fixed-income investments is paramount. As economies evolve, geopolitical landscapes shift, and technological advancements reshape financial markets, bonds remain a steadfast pillar in the investment realm, offering stability, diversification, and potential for growth.

In this ever-changing financial landscape, the key to successful bond investing lies in continuous learning, diversification, and adaptability. By harnessing the insights from both historical data and forward-looking analyses, investors can craft strategies that not only weather economic storms but also capitalize on emerging opportunities. Whether it’s the safety of government bonds, the allure of high-yield corporate bonds, or the promise of emerging markets, the bond universe offers avenues tailored to various risk appetites and investment horizons.

As we conclude our exploration of bonds, it’s evident that they are more than just fixed-income instruments; they are a testament to the global economy’s pulse and a reflection of collective aspirations and challenges. For both novice and seasoned investors, bonds offer a journey—a journey of understanding, growth, and potential, set against the backdrop of a dynamic global canvas. Embracing this journey with knowledge, strategy, and foresight can pave the way for financial success and long-term prosperity.

Bitcoin-up is dedicated to providing fair and trustworthy information on topics such as cryptocurrency, finance, trading, and stocks. It's important to note that we do not have the capacity to provide financial advice, and we strongly encourage users to engage in their own thorough research.

Read More